Explain the Difference Between Futures and Forwards

11 rows An agreement between parties to buy and sell the underlying asset at a certain price on a future. The forward and futures market has improved financial services and financial companies are able to reduce their risks.

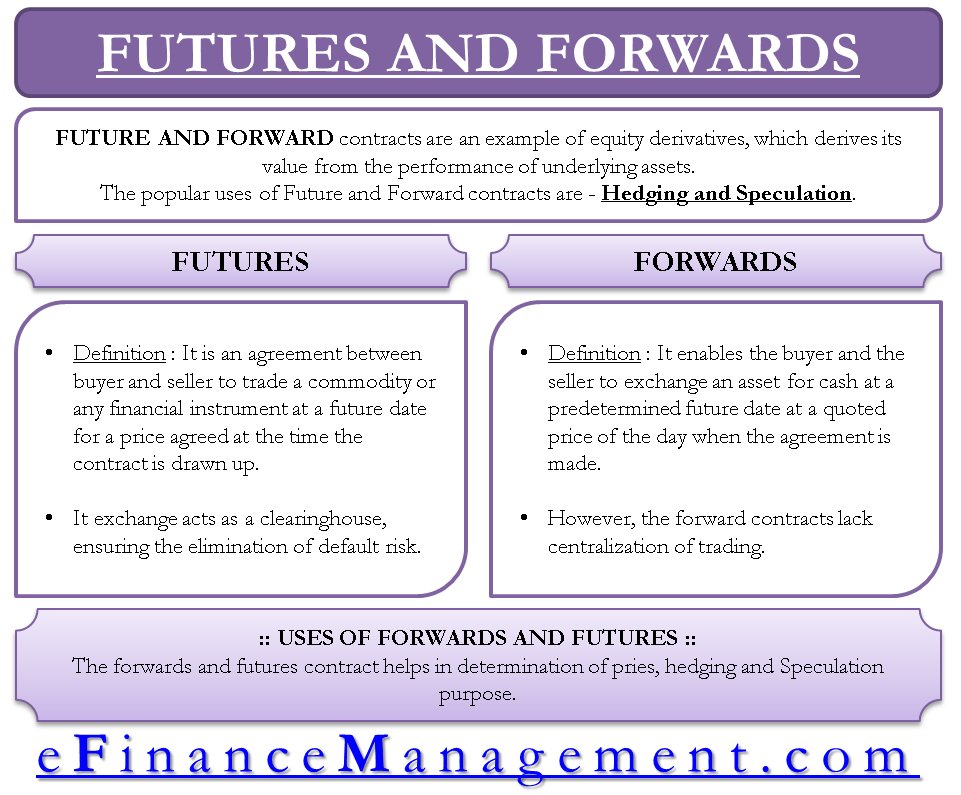

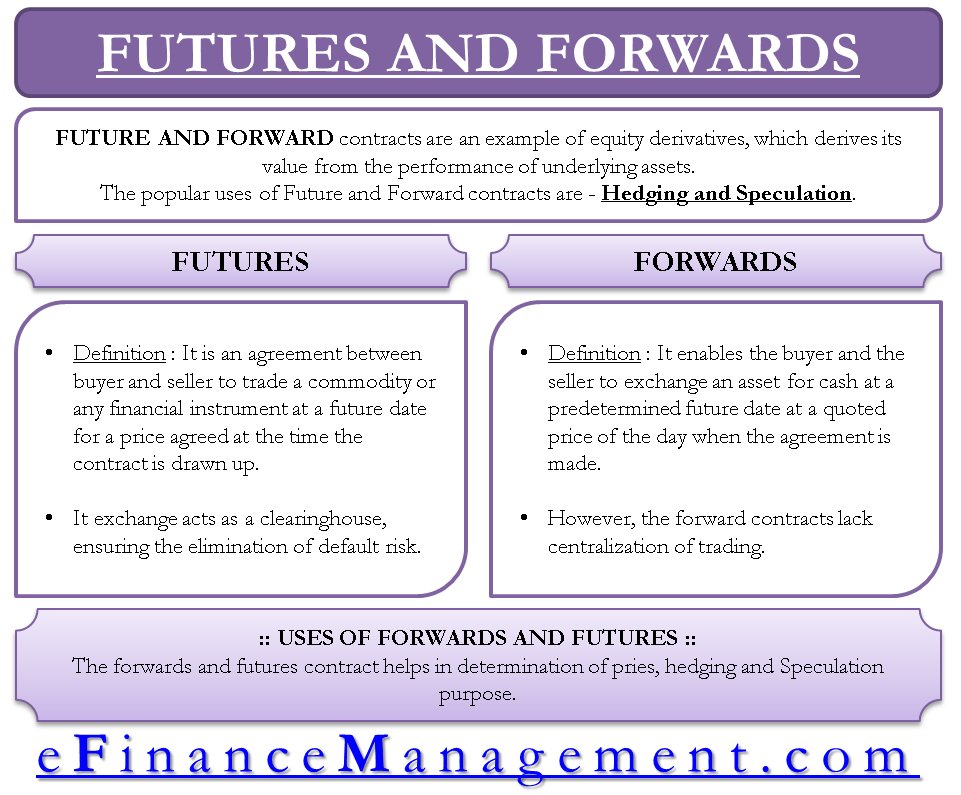

Futures And Forwards Efinancemanagement

One of the main differences between the two is that the forward contract is an over-the-counter agreement between two parties ie a private transaction.

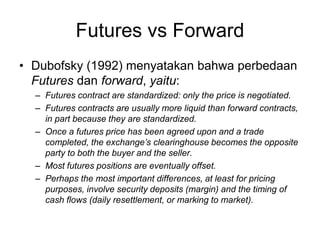

. Forward contracts especially in personal markets are best suited to ensuring that contract terms relating to the former are complied with whereas futures 1 contracts deal with price volatility. For the non-standardized contracts the contract is usually unique to the agreed upon terms. Forward contract is an informal contract between the contracting parties whereas futures contract is standardized and according to specifications of futures exchange market.

Market where price negotiation will be made publically among. That means that with a future contract you can look at the historical trends of the market and identify trading opportunities. Conversely forward contracts may work better for you if you like to make deals with people and do not enjoy reviewing reams of data and historical price charts.

But forward contracts have no daily limits on price fluctuations. The Futures Contract The Futures contracts also referred to as Futures are those standardized instruments that are traded through brokerage firms on the stock exchange which trades that specific contract. These contracts can be customized with respect to the underlying asset time to maturity and the size.

Futures and forwards are similar with differences mostly involving standardization and margin requirement. A futures contract is a standardized contract traded on a futures exchange to buy or sell a certain underlying instrument at a certain date in the future at a specified price. There are two types of market.

The future market specifies a maximum daily price range for each day. Traders will often use futures contracts to directly participate in a move up or down in a particular market without having any need for the physical commodity. However forward contracts generally are private transactions but futures are not.

Future is a traded contract on the future exchange. Also futures trading allows you to trade in a regulated and transparent environment which reduces the likelihood of any shenanigans. A future contract is usually standardized while a forward contract is not standardized.

However forward contracts generally are private transactions but futures are not. On the other hand futures contracts trade on a highly regulated exchange according to standardized features and terms of the contract. Future contracts permit the price risk to be separated from the reliability risk by removing the former from the set of factors giving rise to opportunism.

These are standardized contracts and the lot size and maturity date cannot be adjusted to meet the requirements of the person going long or short. The major difference between an option and forwards or futures is that the option holder has no obligation to trade whereas both futures and forwards are legally binding agreements. Hence a futures market participant is not exposed to more than a limited amount of daily price change.

A forward contract is an agreement between two parties to buy or sell an asset which can be of any kind at a pre-agreed future point in time at a specified price. Forward and Futures markets reduce risks for financial companies. There is no specific maturity date and it is as per the forward contract.

Futures are exchange-traded derivative instruments. Futures are traded on an exchange whereas forwards are traded over-the-counter. Market where price negotiation will be made privately between two parties is OTCOver the Counter Market.

Also futures differ from forwards in that they are standardized and the parties meet through an open public exchange while futures are private agreements between two parties. The policies used in futures come from a central regulatory authority while forwards take their policies from provisions in contract law. In futures contract maturity date is fixed which can be 3rd Wednesday of March June September or December.

Futures contracts are highly standardized whereas the terms of each forward contract can be privately negotiated. The major difference between Futures and Forwards is that Futures are traded publicly on exchanges and the Forwards are privately traded. Futures and forwards are financial contracts which are very similar in nature but there exist a few important differences.

Traders will hold their positions for various lengths of time ranging from day trading to longer term holdings of weeks to months or longer. 20 rows Difference Between Futures vs Forward. Answer 1 of 4.

With various credit instruments available and resources made available from various sources the financial companies are in a position to earn good profits even with a very low margin in their. Forwards and futures are both forms of derivatives that are priced as per an underlying asset. Conclusion Forwards and futures are both available as methods of agreeing on the exchange terms of an asset on a prior date to the actual exchange.

The future market and the forward market differ in notable ways. Differences Between Futures and Forwards. Options differ from futures in.

Difference Between Forwardcontracts Futurescontracts Futures Contract Contract Financial Instrument

Comments

Post a Comment